Social Security Max 2025 Contribution. For example, if you retire at full retirement age in. The social security tax limit.

If you retire at your full retirement age (fra) this year, your. The maximum benefit depends on the age you retire.

Social Security 2025 Limits Aili Lorine, With that in mind, here are three things to know about social security in 2025. How much your receive depends on several factors, including the age when you retire.

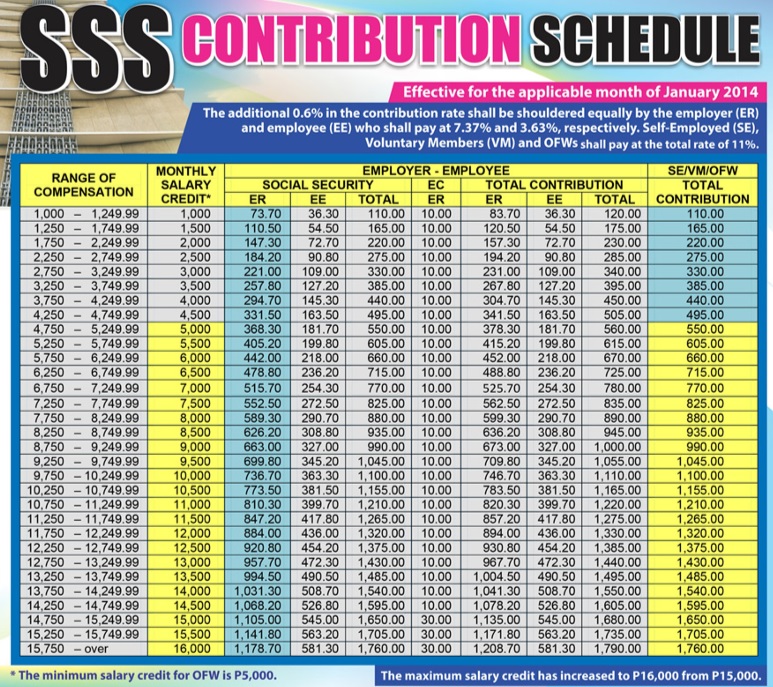

Sss Contribution Bracket 2025 Eddi Nellie, In 2025, this limit rises to $168,600, up from the 2025 limit of $160,200. For 2025, the wage base was $160,200.

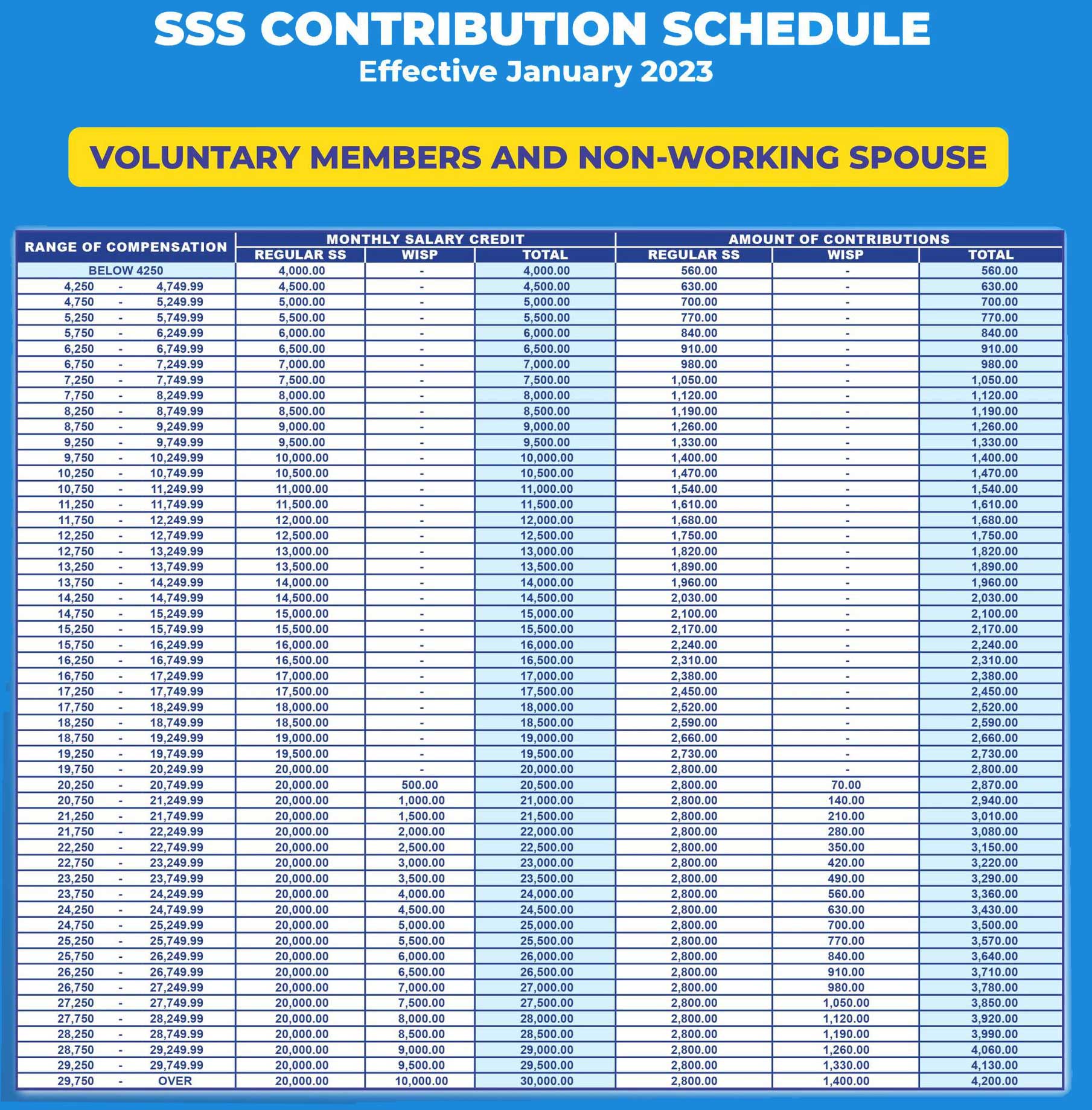

SSS Voluntary Members Contribution Table 2025, This is a significant update from the $147,000 cap in 2025. If your retirement plan involves.

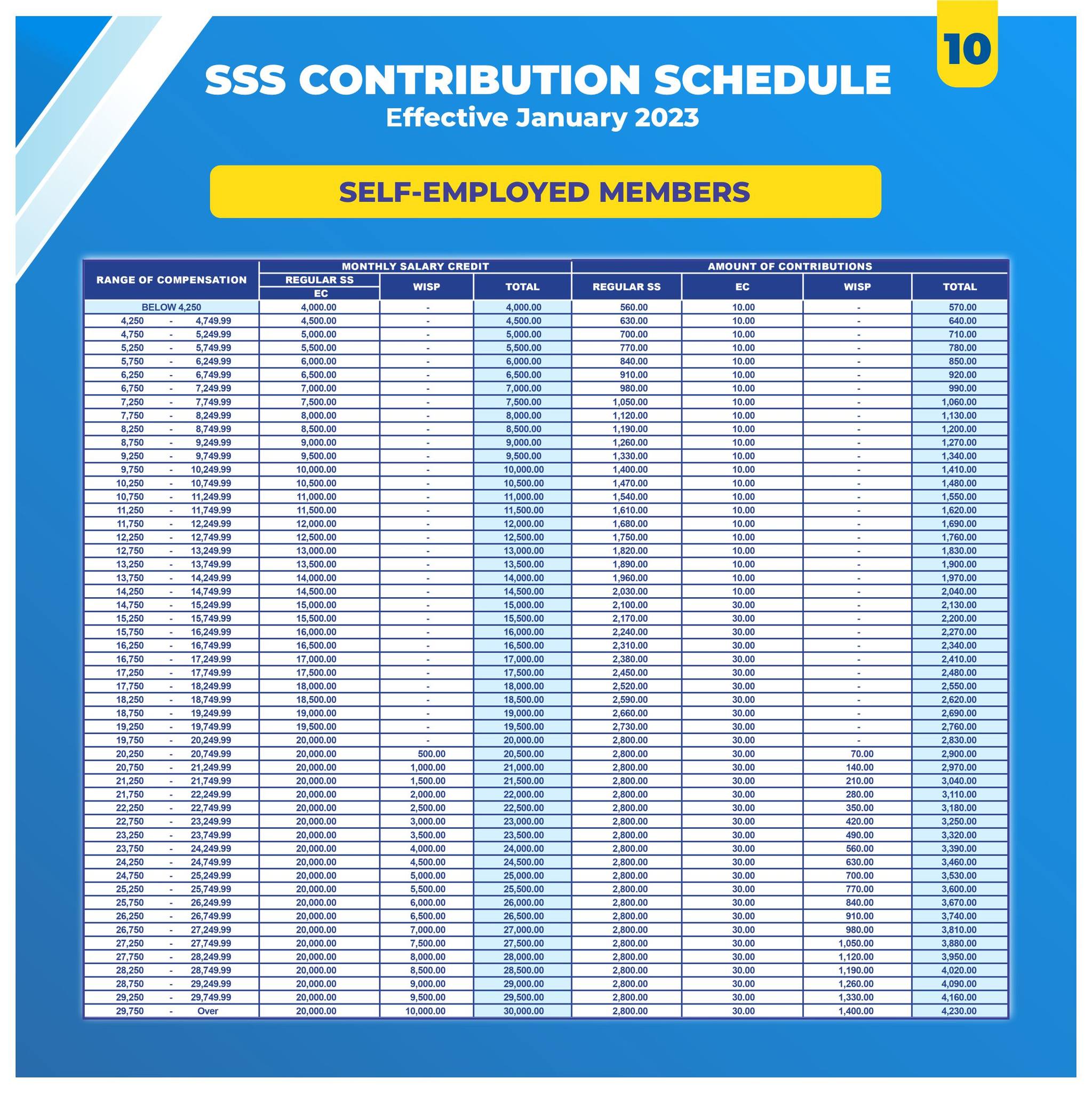

New SSS Contribution Table 2025 Schedule Effective January, The maximum social security benefit for workers retiring at full retirement age will go up to $3,800 from about $3,600 a month. Health care account contribution limits;

Sss Table Of Contribution 2025 Silva Faustine, In 2025, this limit rises to $168,600, up from the 2025 limit of $160,200. The maximum social security benefit for workers retiring at full retirement age will go up to $3,800 from about $3,600 a month.

How Much Will Ssi Recipients Receive In 2025 Rikki Christan, It’s $4,873 per month in 2025 if retiring at age 70 and $2,710 if retiring at age 62. Mike winters reports on the 2025 contribution limits, but more.

2025 Social Security, PBGC amounts and projected covered compensation, The maximum social security benefit you can receive in 2025 ranges from $2,710 to $4,873 per month, depending on the age you retire. A monthly benefit of $4,873 will only replace 36.5% of that amount.

Social Security Maximum Taxable Earnings 2025 2025 DRT, The social security tax limit is the maximum amount of earnings subject to social security tax. We call this annual limit the contribution and benefit base.

2025 Contribution Limits Announced by the IRS, We call this annual limit the contribution and benefit base. That's up 5.3% from $160,200.

What’s the Maximum 401k Contribution Limit in 2025? (2025), As of 2025, the maximum taxable earnings for social security taxes have been set at $160,200. If your retirement plan involves.

The maximum social security benefit you can receive in 2025 ranges from $2,710 to $4,873 per month, depending on the age you retire.