Minimum Earning To File Taxes 2025. The income up to $11,600 will be taxed at 10%, yielding $1,160. Citizens and permanent residents who work in the united states need to file a tax return if they make more than a certain amount for the year.

The internal revenue service (irs) sets minimum income thresholds based on filing status and age. Citizens and permanent residents who work in the united states need to file a tax return if they make more than a certain amount for the year.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Have to file a tax return. If you file on paper, you should receive your income tax package in the mail by this date.

Earned Tax Credit City of Detroit, You probably have to file a tax return in 2025 if your 2025 gross income was at least $13,850 as a single filer or $27,700 if married filing jointly. Minimum income to file taxes for the 2025 tax year.

Here are the federal tax brackets for 2025 vs. 2025, Have to file a tax return. Generally, you need to file if:

Tax Return for FY 202324 Last Date and Deadline; Easy and, Minimum income to file taxes for the 2025 tax year. Citizens and permanent residents who work in the united states need to file a tax return if they make more than a certain amount for the year.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Washington — the internal revenue service today urged taxpayers to take important actions now to help them file their 2025 federal income tax. See current federal tax brackets and rates based on your income and filing status.

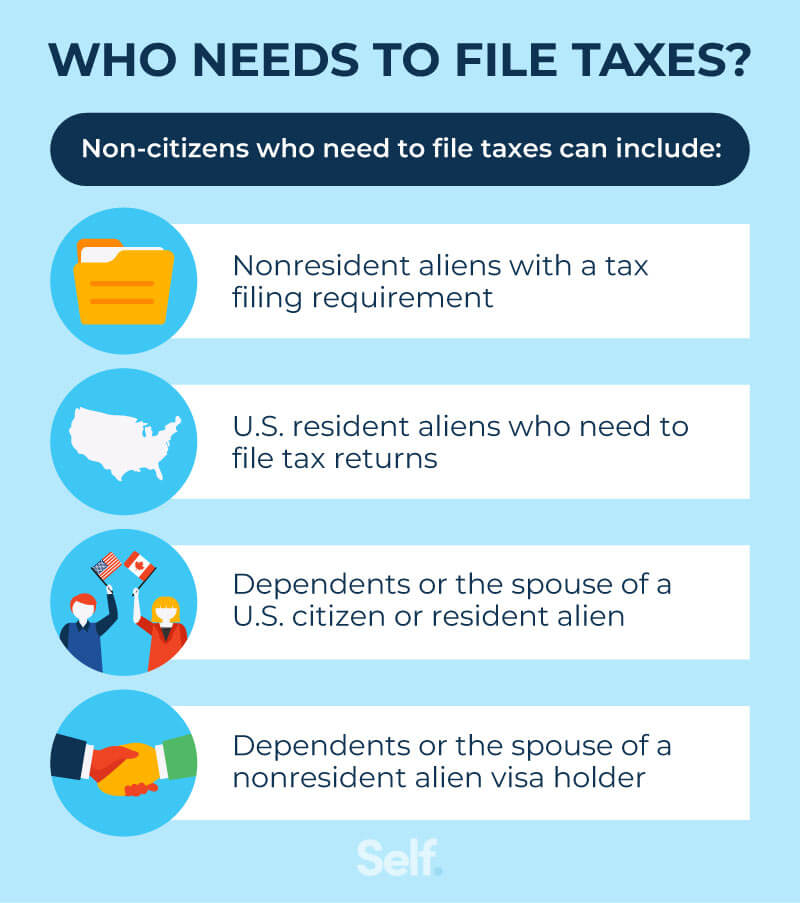

How to File Taxes Without a Social Security Number Self. Credit Builder., This number goes up to $13,850 for 2025 income. Here are the irs filing thresholds by filing status:

2025 Tax Filing Threshold Printable Forms Free Online, Learn how to qualify and maximize your refund when you file taxes for the. Have to file a tax return.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. For the 2025 tax year, the irs has raised the standard deduction to reflect inflation adjustments.

What Documents Do You Need to File Taxes? Experian, Your gross income is over the. Depending on your age, filing status, and dependents, for the 2025 tax year, the gross income threshold for filing taxes is between $12,950 and.

Tax rates for the 2025 year of assessment Just One Lap, See current federal tax brackets and rates based on your income and filing status. If you file on paper, you should receive your income tax package in the mail by this date.