Arizona Unemployment Tax Rate 2025. The 2025 tax rates and thresholds for both the arizona state tax tables and federal tax tables are comprehensively integrated into the arizona tax calculator for 2025. The annual futa tax you pay is used to fund the administrative costs of the unemployment insurance program while your arizona state unemployment tax is used solely.

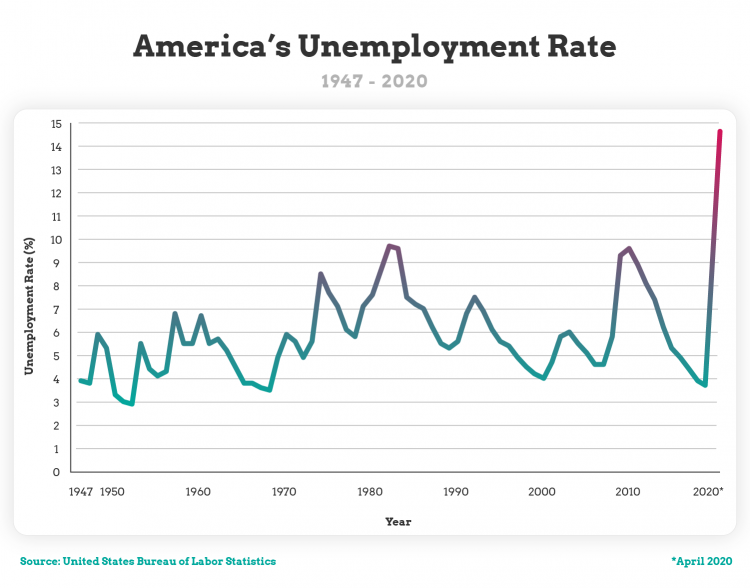

Unemployment rate in arizona was 3.40% in july of 2025, according to the united states federal reserve. Historically, unemployment rate in arizona reached a record high of 13.80 in april of.

Unemployment Extension 2025 Arizona Gabi Carmita, And how to calculate your state’s annual suta rate.

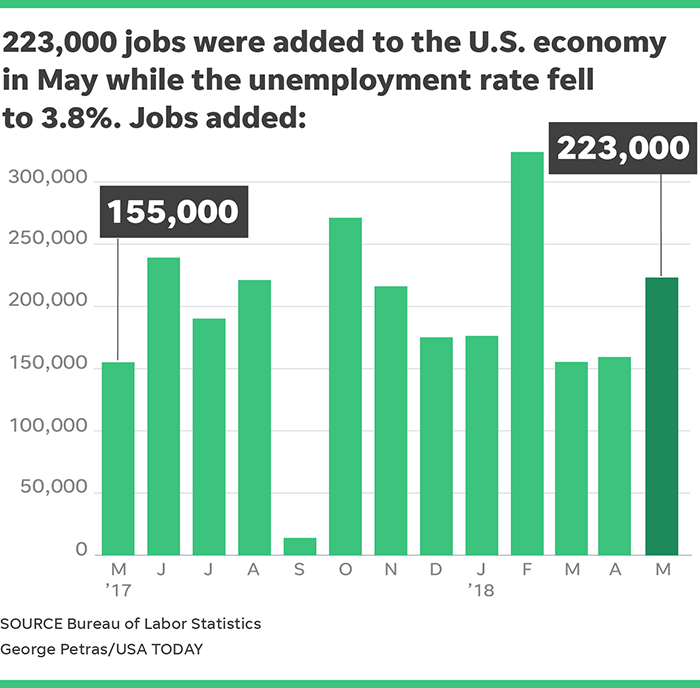

How Much Is Unemployment In Az 2025 Rois Vivien, Employment, hours, and earnings from the ces survey (state and area) local area unemployment statistics;

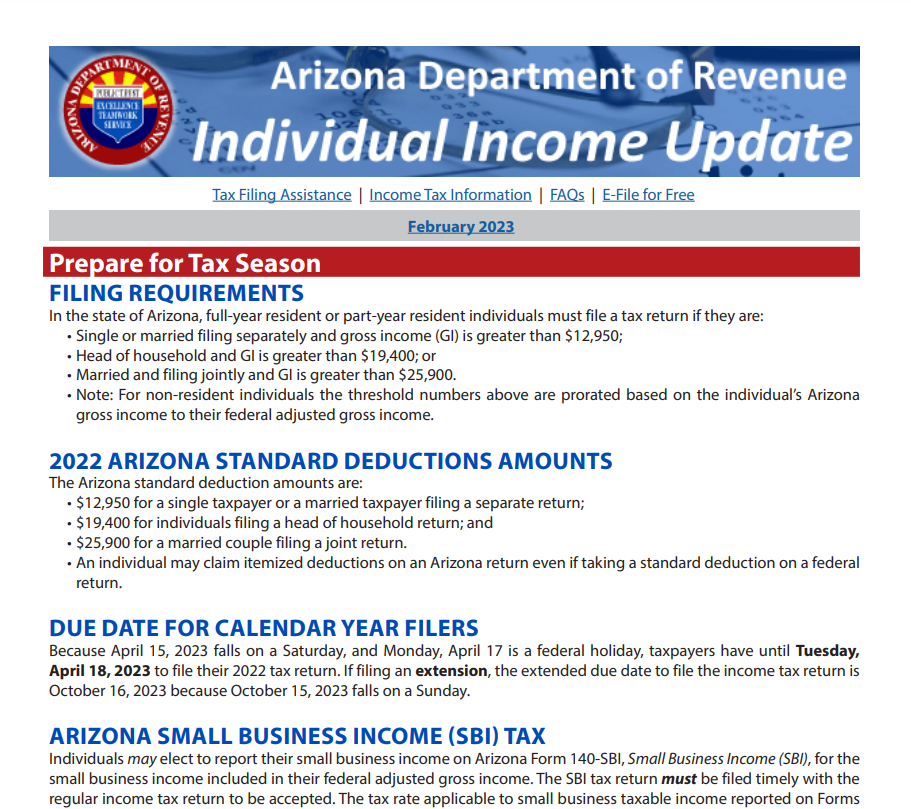

How Much Is Unemployment In Az 2025 Rois Vivien, Arizona taxes unemployment benefits at the same rate regular income is taxed.

Employer Federal Unemployment Tax Rate 2025 Jilly Lurlene, However, there’s a good chance you’ll pay less income tax in arizona this year since the state.

Arizona Tax Rate 2025 Calculator Beckie Rachael, While the unemployment tax rates continue to range from 0.25% to 5.4% in 2025, an employer's tax rate may change based upon the new reserve ratio changes for the 18 rate classes.

State Unemployment Tax 2025 Cleo, You may choose to have federal income tax withheld from your unemployment benefit payments at the rate of 10% of your gross weekly benefit rate (before deductions for earnings, benefit.

What Is My State Unemployment Tax Rate? 2025 Rates by State, Completing and filing online tax and wage reports using the arizona tax and wage system (tws) tws automatically computes your unemployment insurance (ui) tax at the rate.

Us Unemployment Rate 2025 Prediction Tana Rosanna, The annual futa tax you pay is used to fund the administrative costs of the unemployment insurance program while your arizona state unemployment tax is used solely.

Unemployment Insurance Tax Codes Tax Foundation, Current law allows a $3 deduction for tipped workers, bringing their base down to $11.35.