2025 Retirement Tax Tables. National pension system (nps) the national pension scheme (nps) is a central government social security. ★★★★★ [ 120 votes ] this page contains the tax table information used for the calculation of tax and payroll deductions in district of columbia in 2025.

We have revised our 2025 outlook for property operating expense growth downward from 4.50% to 3.25% at the midpoint of our guidance range as a result of. Nebraska widower filer standard deduction.

Tax rates for the 2025 year of assessment Just One Lap, National pension system (nps) the national pension scheme (nps) is a central government social security. See current federal tax brackets and rates based on your income and filing status.

Optimize Your Retirement With This Roth vs. Traditional 401k Calculator!, The tax tables below include the tax rates, thresholds and allowances included in the alabama tax calculator 2025. 2025 tax tables [quick links] personal income tax tables.

2025 Required Minimum Distribution Table Lonna Fredelia, The tax tables below include the tax rates, thresholds and allowances included in the idaho tax calculator 2025. National pension system (nps) the national pension scheme (nps) is a central government social security.

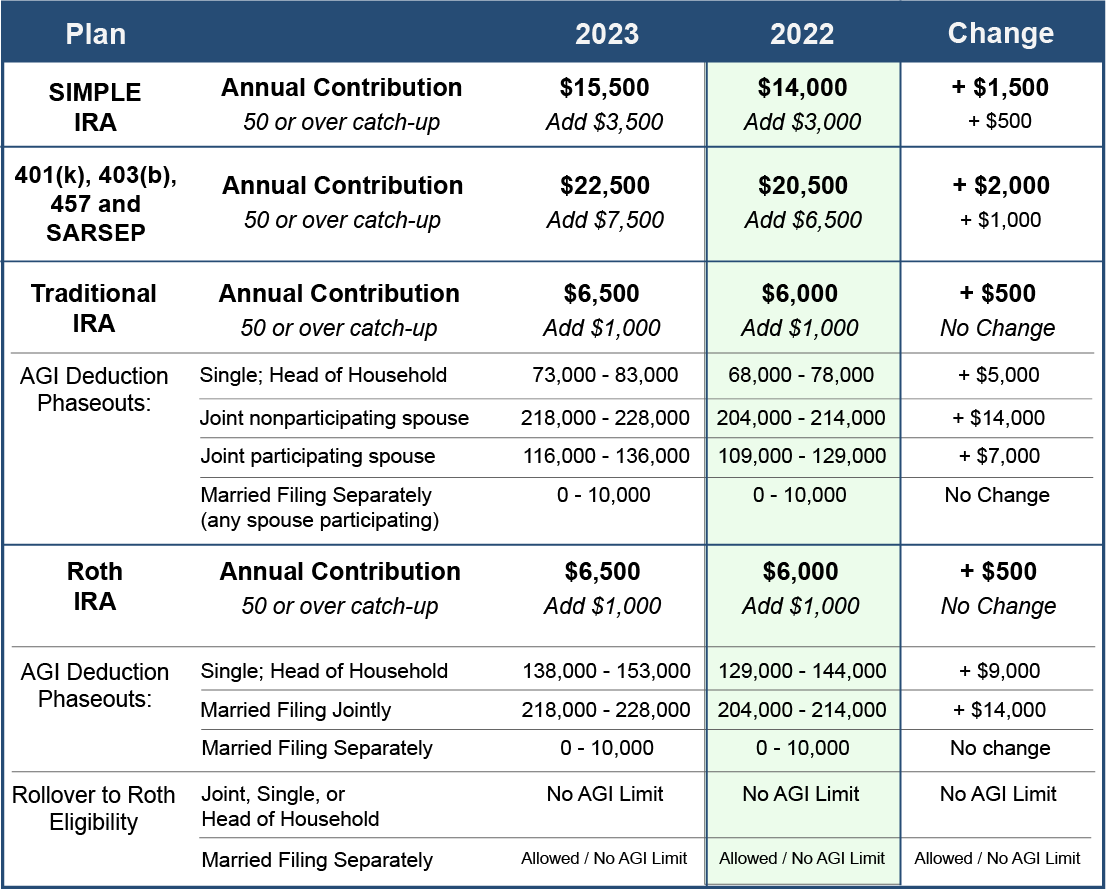

Irs Limits For 2025 Melva Sosanna, We have revised our 2025 outlook for property operating expense growth downward from 4.50% to 3.25% at the midpoint of our guidance range as a result of. Page last reviewed or updated:

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). National pension system (nps) the national pension scheme (nps) is a central government social security.

Retirement Tax Planning 6 Things You Must Know, The tax tables below include the tax rates, thresholds and allowances included in the namibia tax calculator 2025. The irs this week announced higher federal income tax brackets, standard deductions, and retirement plan contribution limits for 2025.

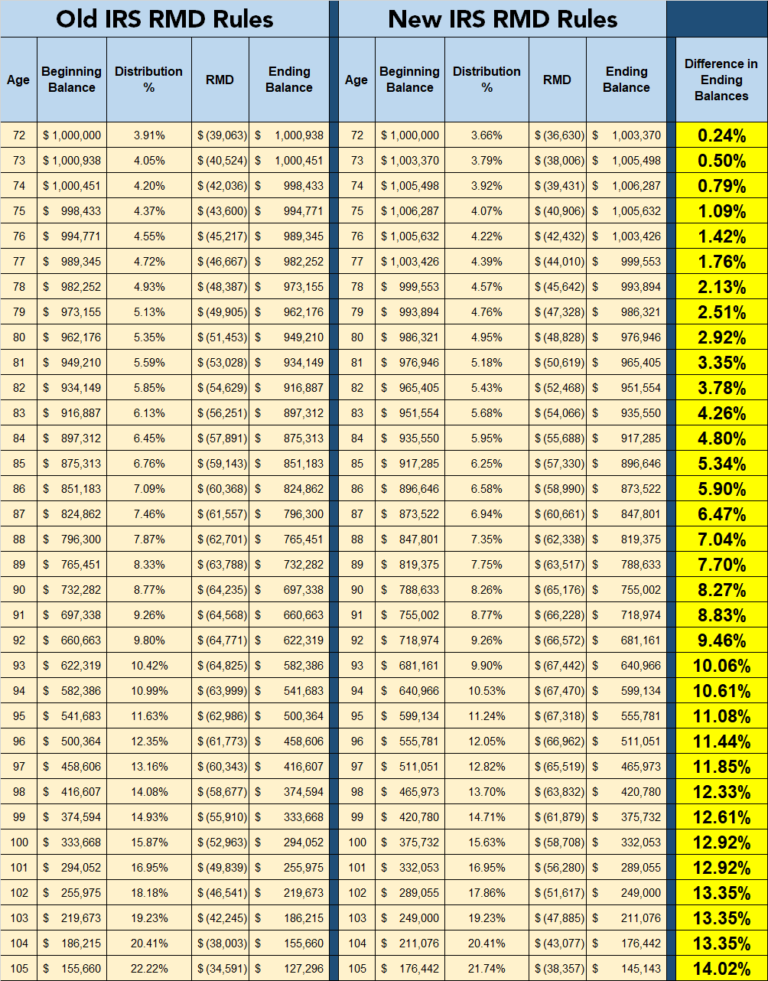

IRS Change Will Decrease RMDs Beginning in 2025 Level Financial Advisors, Chris gentry has been saving diligently for retirement but is concerned about fees in his 401 (k). Page last reviewed or updated:

2025 Retirement Plan Updates from IRS Financial AdvisorRetirement, One of the most reliable and beneficial tax. In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

The table shows the tax brackets that affect seniors, once you include, This may be different for tax credits and child benefit.. The irs this week announced higher federal income tax brackets, standard deductions, and retirement plan contribution limits for 2025.

Plan Your 2025 Retirement Contributions Velisa Bookkeeping Services LLC, Social security rates and thresholds. The 2025 tax rates and thresholds for both the montana state tax tables and federal tax tables are comprehensively integrated into the montana tax calculator for 2025.

F150 Tow Capacity 2025. Ford f150 xlt towing capacity, conventional tow rating, the 2025 ford […]

Counselling Conferences 2025. 2025 american counseling association conference & expo. Upcoming events in the field […]